How to Read Your Tax Statement

Video here from District Administrator explaining how to read your tax statement.

Tax bills are sent out annually in mid-December. The details below will help you understand the various sections of the tax statement.

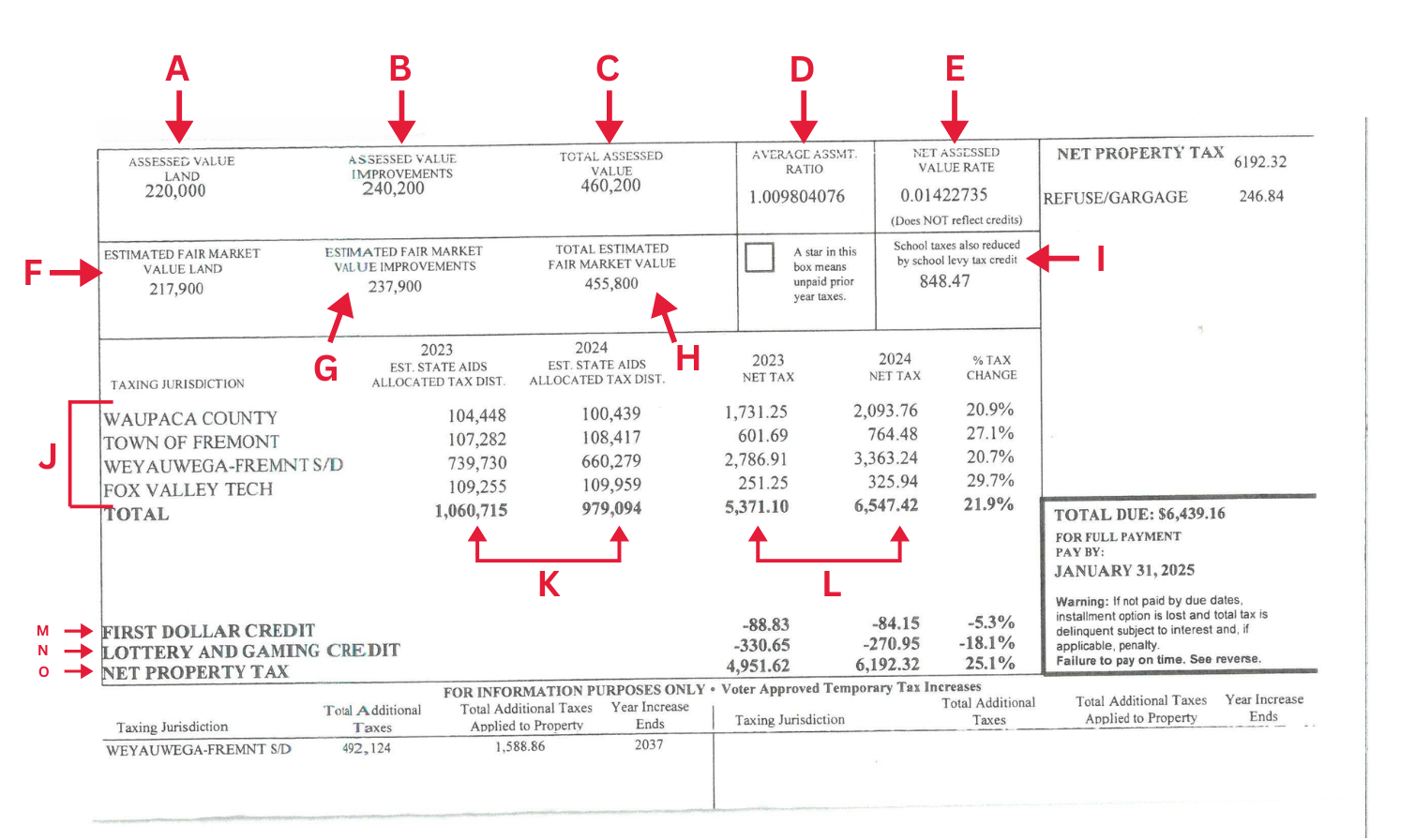

The image provided shows an actual tax statement with personal information removed. Each red letter corresponds to a description listed beneath the image. Definitions of key terms can be found at the bottom of the page.

(A) Assessed Value Land: The value of taxable land, as determined by the assessor for the purpose of taxation.

(B) Assessed Value Improvements: The value of taxable buildings, as determined by the assessor for the purpose of taxation.

(C) Total Assessed Value: The total value of land and buildings, as determined by the assessor for the purpose of taxation. This figure is the sum of A and B above, and may be higher or lower than the current market value of the property.

This is multiplied by the net assessed value rate (tax rate) to determine the amount of tax that each property owner must pay.

(D) Average Assessment Ratio: The average assessment ratio is determined by the Wisconsin Department of Revenue and is used in calculating the estimated fair market value shown on the tax bill.

The assessed value divided by the average assessment ratio = estimated fair market value.

For example, if the assessment of a parcel of land, which sold for $150,000 (fair market value) was $140,000, the assessment ratio is said to be 93% (140,000 divided by 150,000).

(E) Net Assessed Value Rate (Tax Rate): The tax rate is determined by dividing the amount of the tax levy -- that is, the total amount that is taxed in the entire district -- by the total assessed value of all of the property in the district. The tax rate is then multiplied by the total assessed value to determine the amount of tax that each property owner must pay.

(F) Estimated Fair Market Land: This figure is the assessed value land figure (A) divided by the average assessment ratio (D).

(G) Estimated Fair Market Improvements: This figure is the assessed value improvements figure (B) divided by the average assessment ratio (D).

(H) Total Estimated Fair Market Value: This figure is the sum of the estimated fair market land figure (F) and the estimated fair market improvements figure (G).

(I) School Levy Tax Credit: The school levy tax credit is a credit that is paid to municipalities, not the school district, in an effort to offset property taxes.

Despite the fact that the funds for the credits do not go to schools, the state considers these dollars part of its commitment to education.

School levy tax credits are distributed based on each municipality's share of statewide levies for school purposes. These amounts are decided based on the value of an individual property as a percentage of the district's total value.

This credit is automatically applied to all properties that qualify.

(J) Taxing Jurisdictions: In most parts of the state, there are five "taxing jurisdictions:" the state, the county, the city or village, the school district, and the local technical college. This area lists them. Each jurisdiction determines its own levy.

(K) State Aid: This shows the revenue received from the state for each jurisdiction, for this and the prior year. It is important to note that the most recently passed state budget reduces the amount of aid provided to schools and shifts the responsibility to pay for Wisconsin public schools to property tax payers.

(L) Information from Prior Years: This shows the taxes due for each jurisdiction. For comparison, the figures for the prior year are listed with the percent change.

(M) and (N) First Dollar Credit and Lottery and Gaming Credit: Like the School Levy Tax Credit,

the First Dollar Credit issues revenues back to the public in order to offset property taxes. This money does not go to schools, although the state considers it part of its commitment to education. It should be automatically applied to all qualifying properties.

The Lottery and Gaming Credit is a property tax credit, which is provided by the State from its lottery and gaming revenues. The lottery and gaming credit is determined in November of each year and depends on the revenue gained from lotteries, pari-mutuel on-track betting, and bingo for the year. In most cases, the credit is applied automatically.

(O) Net Property Tax: This figure is the total property tax minus the lottery and gaming credit, described below.

DEFINITION OF TERMS

The following terms are used on tax bills, in this document, and in other written material about property taxes.

Assessed Value: The value that is assigned to property by the assessor, for the purpose of taxation.

Assessment Ratio: The average assessment ratio is provided by the Wisconsin Department of Revenue and is used in calculating the estimated fair market value shown on tax bills. Assessed value is divided by the average assessment ratio to get the estimated fair market value.

For example, if the assessment of a parcel of land which sold for $150,000 (fair market value) was $140,000, the assessment ratio is said to be 93% (140,000 divided by 150,000).

Equalized Value: This is the estimated value of all taxable property in the district. The value used is the market value, which is the most probable selling price.

FairMarket Value: This is the real market value of a property. In other words, it is the price for which a property would be sold by a willing seller to a willing buyer, under normal market conditions.

Levy: The total amount of property taxes imposed by a taxing jurisdiction.

Taxation District: A city, village, or town. If a city or village lies in more than one county, this is the portion of the city or village which lies within each county.

Taxing Jurisdiction: Any entity authorized by law to levy taxes on property located within its boundaries. This includes the state, the city (or other local government), the county, the school district, and/or the local technical college.